Recent Insights

The Two Faces of Powell

Friday’s announcement from the U.S. Bureau of Labor Statistics of 517,000 net new jobs last month was a shocker and far above the CNBC consensus of 187,000. In part, the economy is expanding. In part, the huge number of job openings has not yet abated, even as companies in some industries continue to backfill open positions that should have been filled months ago.

10 Important Changes to Retirement Planning

At the end of last year, Congress passed the SECURE Act 2.0, a follow-up to an overhaul of retirement laws passed just three years ago. The changes make it easier to save for retirement and may stretch out your savings while in retirement.

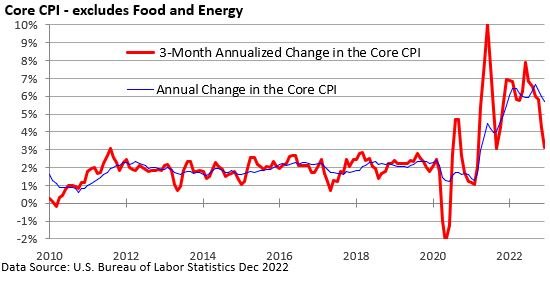

Meaningful Progress

There has been meaningful progress on the inflation front. The annual rate of inflation has slowed, and the ever-visible price of gasoline is well off last year’s high. But as every child has asked on a long road trip, “Are we there yet?”

Stocks Rally on Hopes Inflation Will Slow

Investors are rooting for a continued slowdown in wage growth and a loosening in the tight labor market but not an outright recession, which would hamper corporate profits. Wages are still rising too quickly for the Fed’s comfort and aren’t compatible with its 2% annual inflation goal. Workers, however, benefit from higher wages, as many have not kept pace with the spike in prices.

Annual Market Insights

The market had a banner year in 2021, with the S&P 500 Index advancing over 25%, according to data from the St. Louis Federal Reserve. But tailwinds that fueled gains in some sectors of the S&P 500 shifted dramatically in 2022.

Not Even a Pivot with a Small ‘P’

Powell said rates are still not high enough. “We'll need to stay there (at a yet-to-be-determined peak) until we're really confident that inflation is coming down in a sustained way. And we think that will be some time.” That wasn’t pivot language. It wasn’t pivot lite. It wasn’t even a pivot with a small ‘p.’

Inverted Yield Curve

It doesn’t happen often (recessions don’t happen often), but it suggests that investors believe short-term rates are headed lower. Maybe not today, but weaker economic conditions would be expected to force the Fed to cut rates. When that has happened in the past, short yields fall faster than longer yields, and the curve normalizes. While it has been a reliable predictor, it has not done a good job of pinpointing the start of a recession.

Can There Be Too Much Hiring?

Can there be too much hiring? Can job growth be too fast? It seems like an odd question. But following a better-than-expected jobs report on Friday and the initial negative reaction (shares pared losses and finished mixed), the question is worth exploring.