Recent Insights

A Big Pile of Cash on the Sidelines

Congress’ response to the pandemic was to flood the economy with cash, including generous jobless benefits, tax credits, and stimulus checks. The extra cash boosted spending, but not all has been spent.

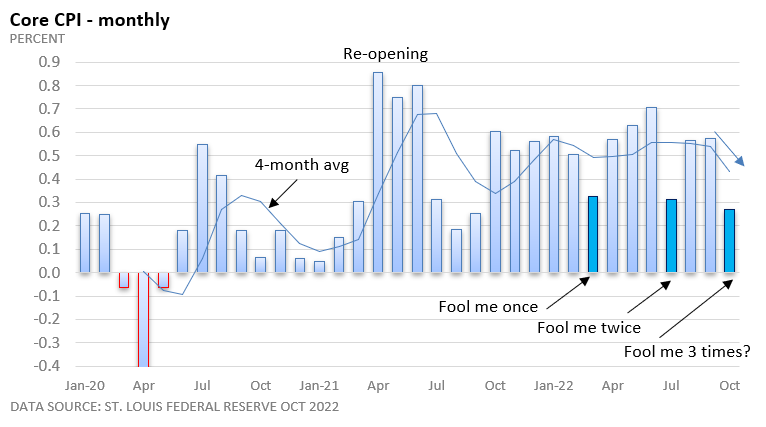

Fed Funds Rate Increases

The Fed may dial back the size of its rate increases—75 bp increases began in June—but the peak in the fed funds rate, what analysts are calling the terminal rate, could be higher than previously expected. And the Fed could maintain that level for a while.

Cracks Gradually Form in the Job Market

It’s not that all workers have their pick of jobs, but many businesses have struggled to fill open positions. We see it in the never-ending stream of help wanted signs.

The Dollar vs the World

Recently, investors are viewing the soaring greenback with apprehension, as some fret over tensions in global markets and added headwinds for earnings of firms that conduct a significant share of business overseas.

Interest Rates - Higher for Longer

Price stability is the bedrock of a healthy economy. For starters, the economic expansion of the 1990s and the 2010s, the longest expansions on record per the National Bureau of Economic Research (data pre-dates the Civil War), was assisted by low inflation.

Doing What Feels Good Isn’t Always Right

We are going to have volatility. There will be headlines that will cause the stock market to have heartburn for a few days.

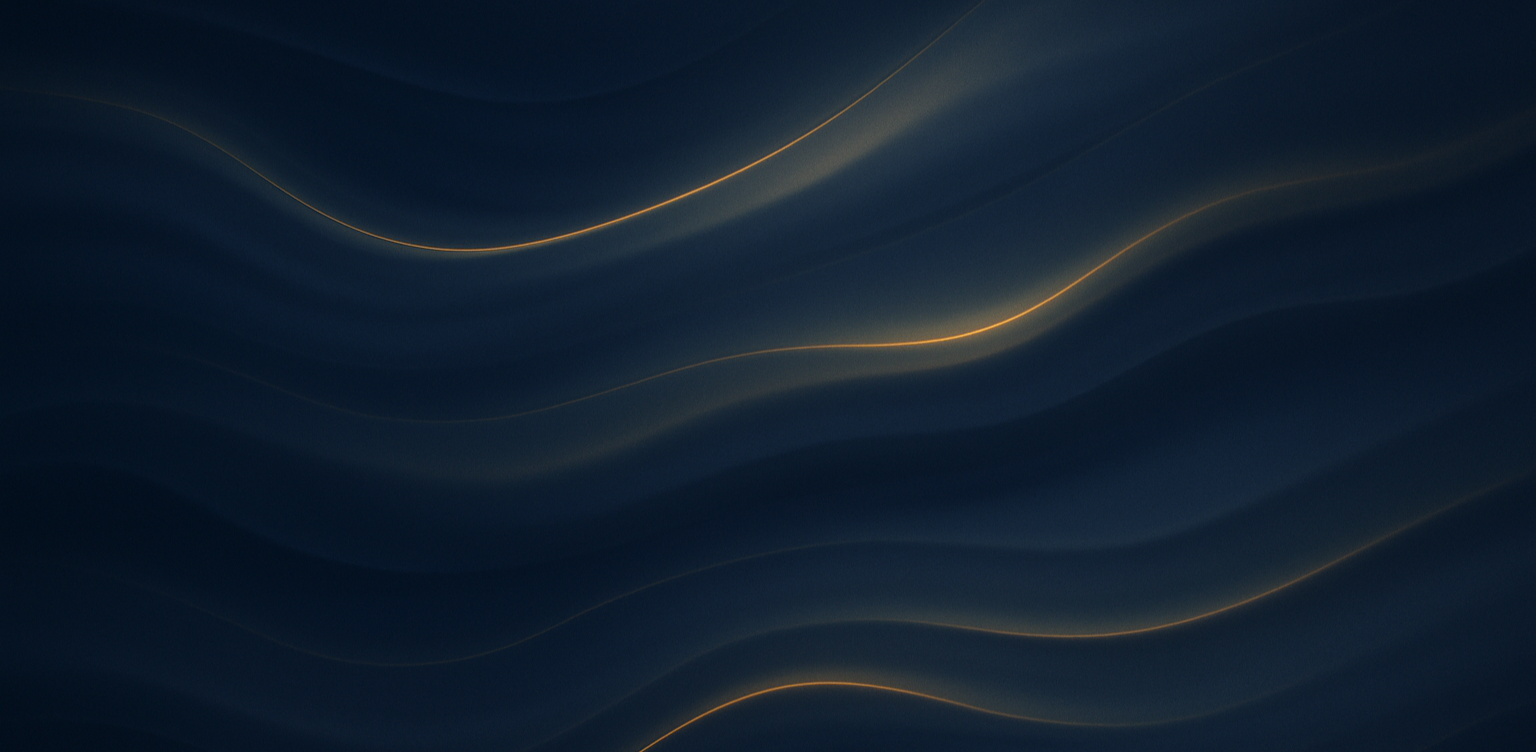

Good Economic News May Encourage Further Hawkishness

The rate of inflation may have already peaked, but whether the rate of inflation might plateau, decline slowly, or fall quickly is up for debate. Yet, even if inflation has peaked, we aren’t yet seeing ‘peak hawkishness’ from Fed officials. Consequently, good economic news may encourage further hawkishness and rate hikes, which has created headwinds for stocks.