Equity Optimizer Performance

Disclosures:

1. Bellwether Advisors, LLC is a registered investment adviser whose principal office is located in Nebraska. Information here is directed toward U.S. Residents only. Bellwether only transacts business in states where it is properly registered or excluded or exempted from registration requirements

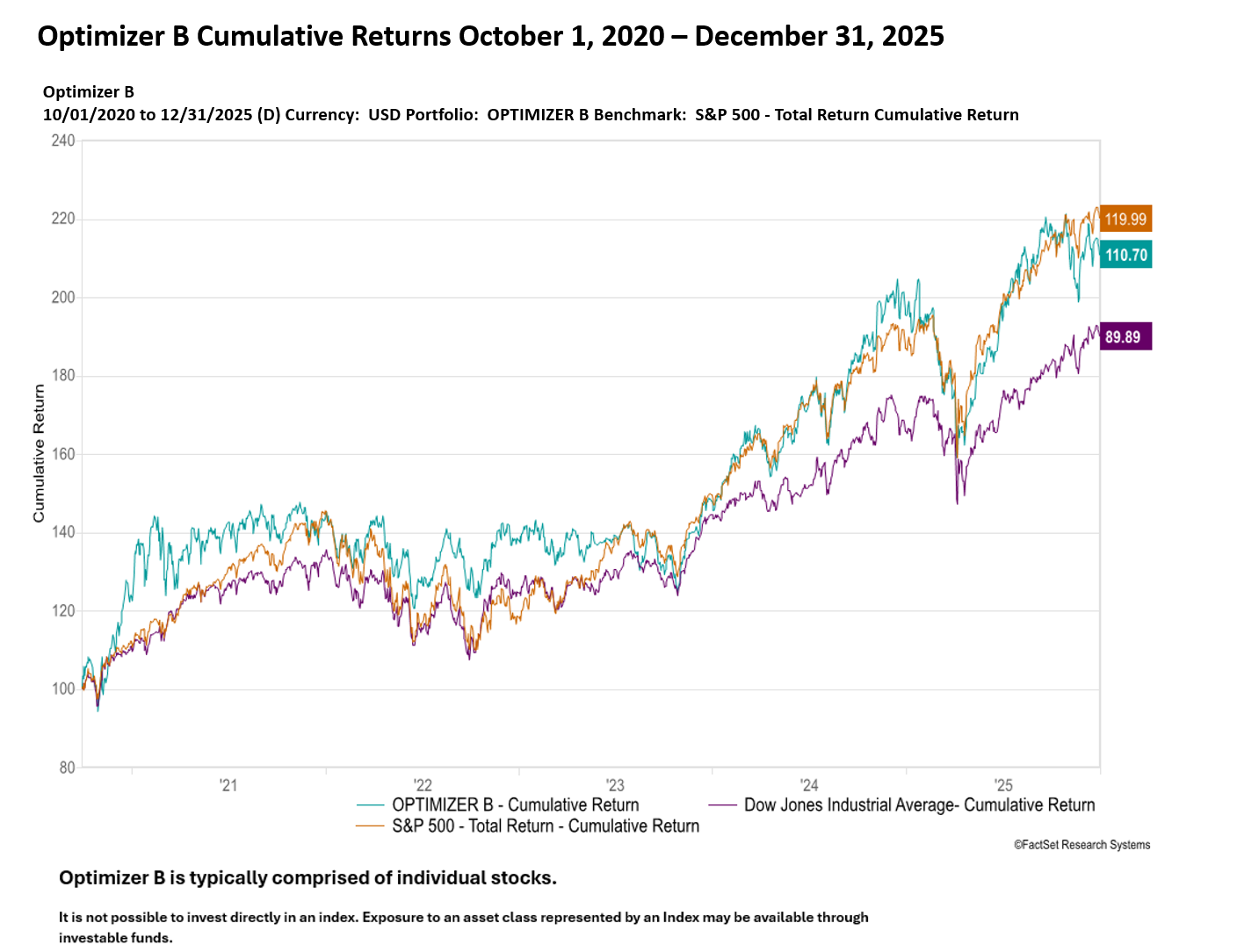

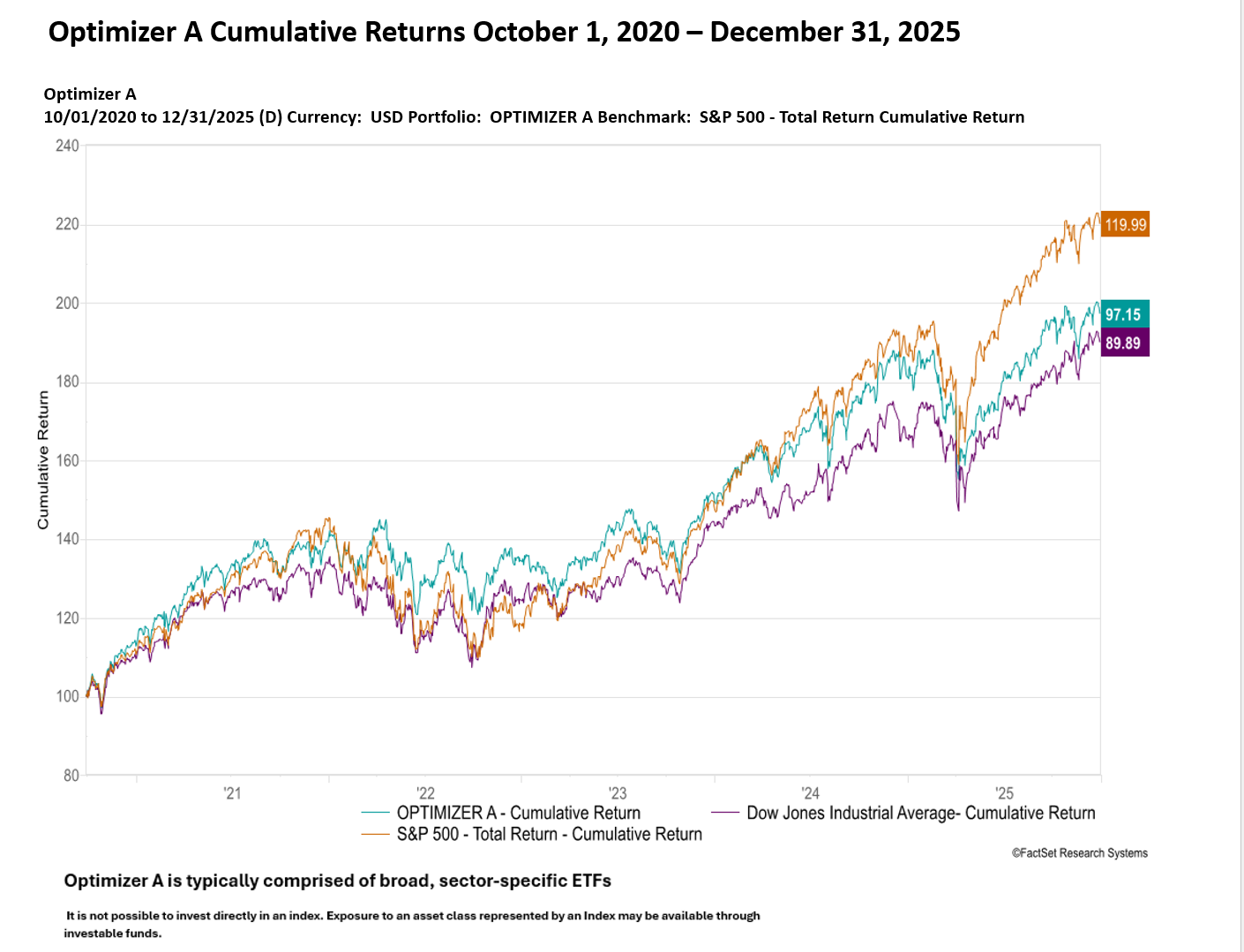

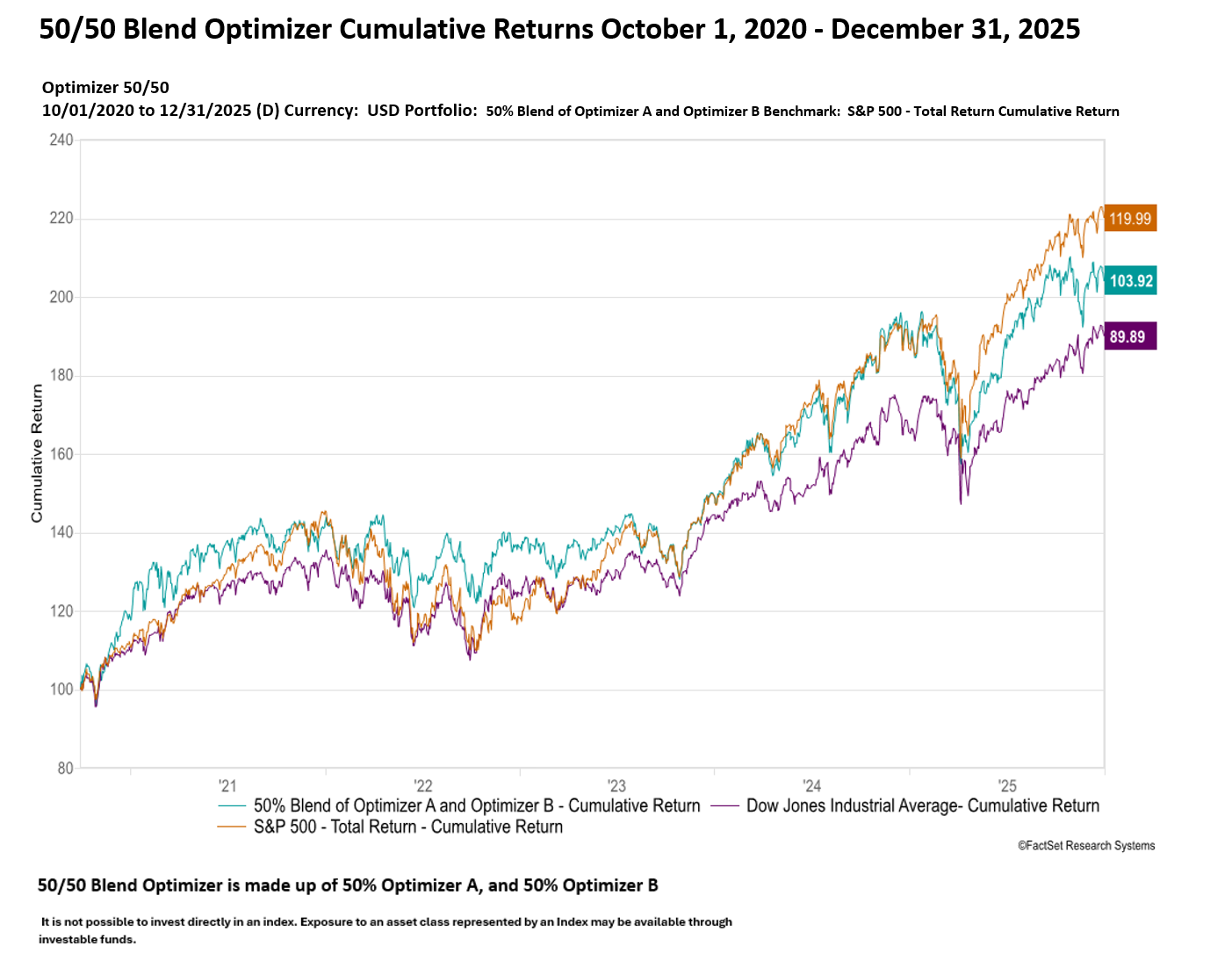

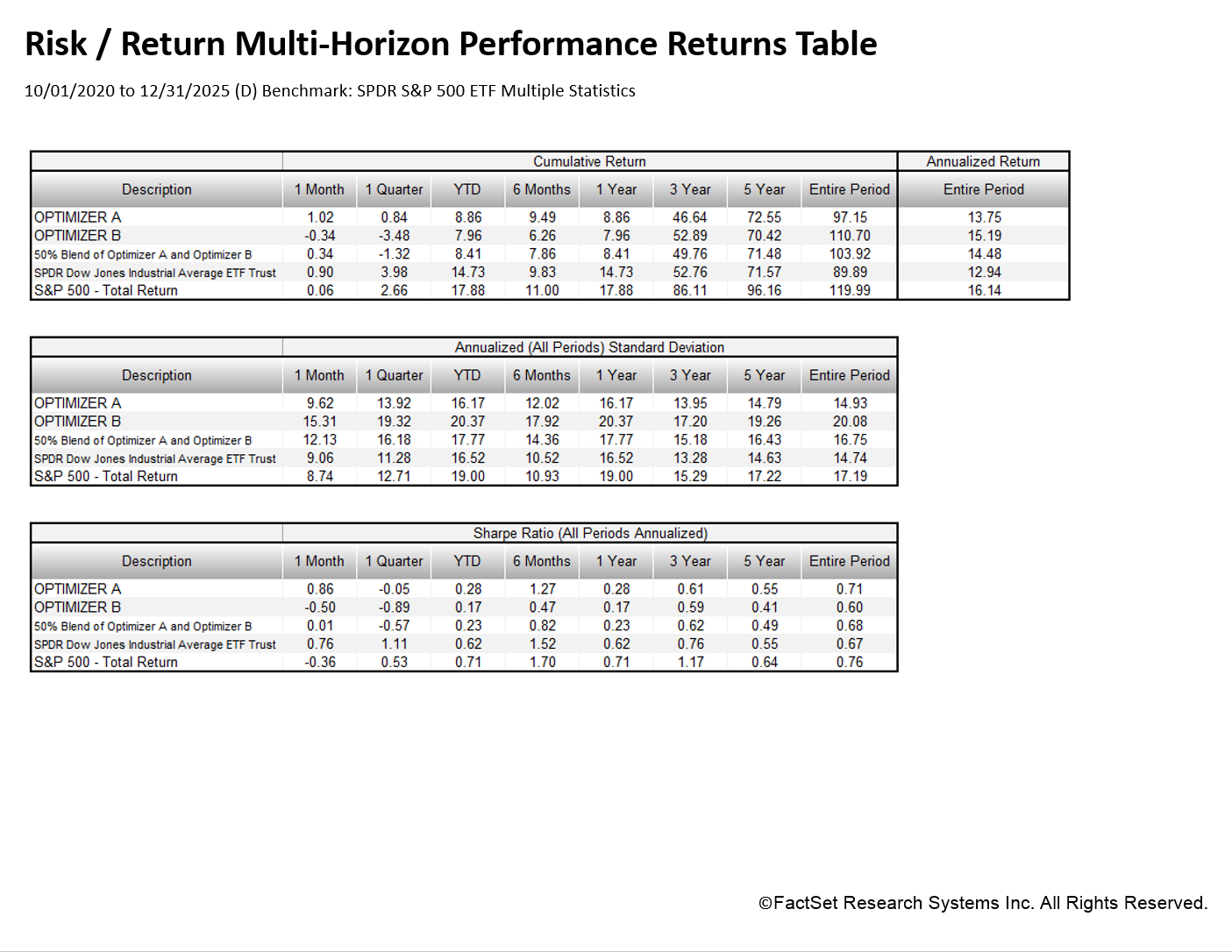

2. The Optimizer model contains 100% Equity Stocks and is managed for aggressive capital appreciation. The composite is being used as only a portion of an investor’s or account’s overall investment portfolio. Investing in 100% stocks can provide significant potential for capital loss, and investors should only invest in the amount of risk consistent with their risk tolerance.

3. The comparison benchmark is the SPDR S&P 500 ETF (Ticker: SPY), and the DOW JONES INDUSTRIAL AVG (Ticker:DIA). Further information regarding the benchmarks is available upon request.

4. Valuations are computed and performance reported in U.S. Dollars.

5. Net-of-fees performance returns are presented after investment management fees (based on maximum fee of 1.25% annualized but billed monthly) and direct trading expenses. Performance results include the reinvestment of all income. Returns are presented gross of all income taxes.

6. Net-of-fees performance returns are presented after investment management fees (based on maximum fee of 1.25% annualized but billed monthly) and direct trading expenses.

7. The performance quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. Performance is calculated and updated on a monthly basis.

8. Additional information regarding policies for calculating and reporting returns is available upon request.

9. Cumulative returns are the compounded daily returns assuming constant-dollar (time-weighted) returns over the time period presented, from 1 October 2020 through 31 December 2025. They are not annualized. Standard Deviations and Sharpe Ratio’s (where presented) are annualized.

10. Past performance is not necessarily an indicator of future results. Information included here is not an offer to buy or sell or a solicitation of any offer to buy or sell the securities mentioned herein.

11. The results for holdings are obtained from third parties deemed by the adviser to be reliable. Nonetheless, the adviser has not verified the results and cannot be assured of their accuracy.

12.The 50/50 Blend Optimizer is a 50% allocation each of Optimizer A and of Optimizer B.

13.The returns reflected in Optimizer A, Optimizer B, and 50/50 Blend Optimizer, are valued based on end of day prices. Client accounts may vary as they will include end of day prices, and intra-day trade execution prices. Thus, the returns shown do not represent the returns you would receive if you traded at other times.