Recent Insights

Inflation Stays Hot

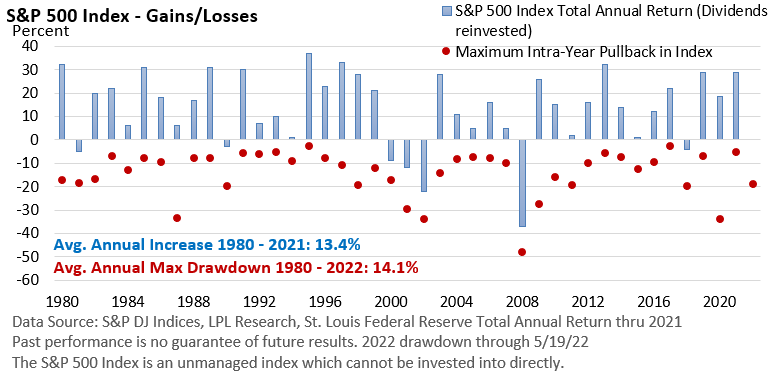

Investors grappled with several conflicting events last week. Given the negative sentiment in today’s environment, the market latched on to the glass-half-empty scenario.

Then and Now

Investors grappled with several conflicting events last week. Given the negative sentiment in today’s environment, the market latched on to the glass-half-empty scenario.

High Anxiety

Investors grappled with several conflicting events last week. Given the negative sentiment in today’s environment, the market latched on to the glass-half-empty scenario.

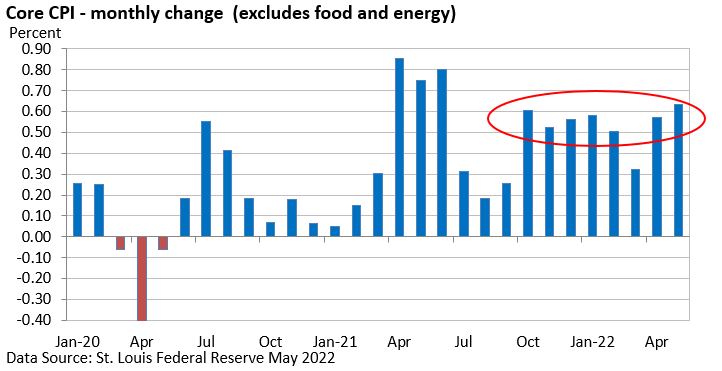

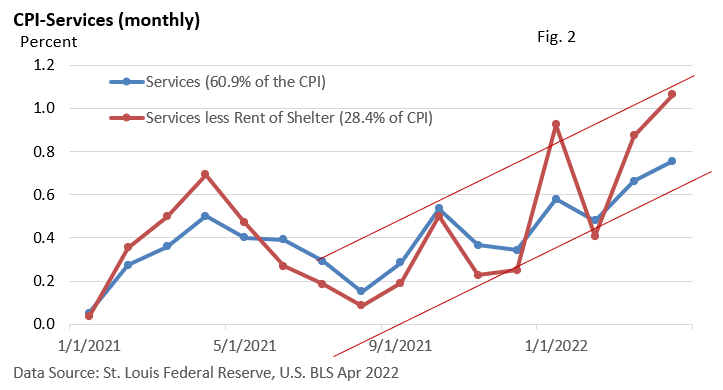

Inflation—Good News, Bad News

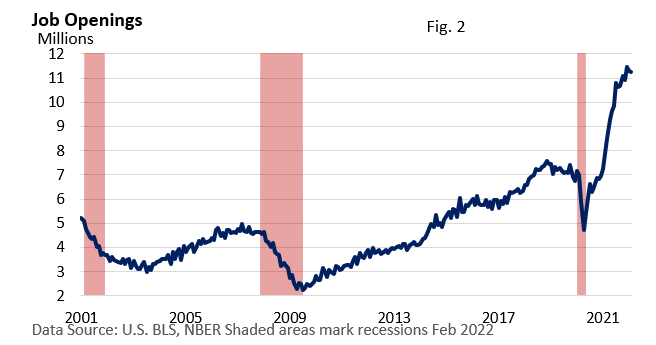

For now, the Fed has its work cut out as they attempt to slow an overheated economy and rein in inflation, without tipping the economy into a recession.

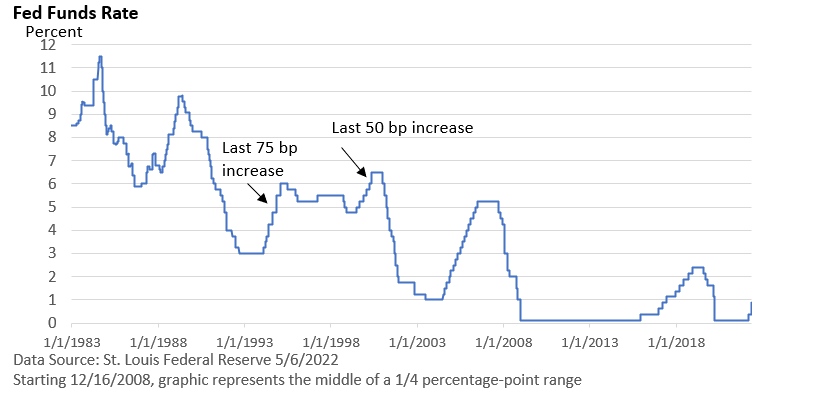

Biggest Rate Hike in Over 20 Years, but More Aggressive Path Quashed

The rate increase was no surprise, and there wasn’t an immediate market reaction. Instead, it was comments that came in the press conference that moved the market.

Is a Drop in GDP a Recession Signal?

Q1 didn’t reflect weakness in consumer or business spending. In fact, it was just the opposite. Government stimulus helped last year. The strong GDP numbers early in the recovery are unlikely to repeat.

A Favorable Start to First Quarter Earnings Season Runs into Rate Fears

First quarter earnings season is in full swing, and as we’ve seen in prior quarters, analysts have been too conservative with their initial estimates. Much of last week, however, investors fretted over how quickly the Fed might raise interest rates.

Inflation Soars, but Is It Peaking?

A 1.2% rise in the Consumer Price Index last month was the biggest increase since 2005, according to the U.S. Bureau of Labor Statistics. Given the spike in energy tied to the Russia-Ukraine war, March’s inflation report was no surprise.